Beyond the Paperwork: How a Trusted Estate Planning Attorney Protects Your Future

When it comes to estate planning, many people focus solely on documents—the will, trust, or power of attorney. But estate planning is more than just...

A timeshare is a property, typically a vacation property, where multiple owners share a right to use the property. Usually, most timeshare owners buy a right to use the property during an allocated week of the year. It is important to remember that a timeshare is not an intangible personal property interest. A timeshare is a real property interest, much like your home or any other land you may own. This means that a timeshare must be planned for or probated like a real property interest.

Planning for what happens to your timeshare after death can be a very tricky process. Most timeshare owners want to pass their enjoyable experiences at their timeshare onto their children or friends. Since timeshares are usually a real property interest, the timeshare must be deeded through the probate process, if the timeshare is not otherwise deeded during life. The probate process is difficult with timeshares because the timeshare is rarely located in the state of the decedent’s residency. This means that an ancillary probate must be done in the state where the timeshare is located and will often cost several thousand dollars in additional attorney fees and court costs.

Timeshares, when probated, are often a luxury burden on the beneficiaries of the decedent’s estate. Even though the owner of the timeshare has died, the owner’s estate is still responsible for the timeshare fees and property tax expenses that are incurred each year. While the decedent may have thought the beneficiary wanted or would enjoy the timeshare, the beneficiary may not want to take on the added expense associated with the time share.

There are a couple of different options available to timeshare owners when completing their estate planning. Each option has its own drawbacks, but the options have some benefits as well.

• Rights of Survivorship: This option is if the timeshare is owned by a married couple or by a couple of people. A property owned with rights of survivorship (commonly known as Joint Tenancy with Rights of Survivorship), means that if one owner dies the property passes automatically to the surviving owners. This option only works if there is still a surviving owner. Once there is only one surviving owner left, the owner must then plan using the following options or add another person as a joint tenant while they are still living.

• Sell the Timeshare: Selling the timeshare is always an option to avoid the probate process. Timeshares are notoriously hard to sell and they often sell for a fraction of the purchase price. Though the property may be sold at a loss, the loss is probably less than the expense that would be incurred during the probate process.

• Abandon the Property: If the beneficiaries cannot afford to keep the timeshare, the beneficiaries can elect to not inherit the property. The Timeshare management will then likely re-absorb the property and re-sell it to recoup any of the expense. There may be fees and tax consequences associated with abandoning a timeshare property.

• Deed the Timeshare into Trust: One of the most favorable options for transferring a timeshare is transferring the timeshare into a revocable trust. The owner then will keep control over the timeshare during their lifetime as a trustee of the revocable trust. The timeshare will then stay in trust for use by the trust’s beneficiaries. However, the trust will still have to pay the applicable fees and taxes for the timeshare.

• Transfer on Death Affidavit: A transfer on death affidavit is an easy way to avoid probate with your timeshare property. A transfer on death affidavit is a type of deeding process that automatically transfers your timeshare property to a beneficiary listed on the affidavit at the time of the owner’s death. Not all jurisdictions recognize transfer on death affidavits and the beneficiary is still responsible for the timeshare expenses if they do recognize a transfer on death affidavit.

If you own a timeshare property, please contact an attorney to help you decide which planning option best suits your needs. Timeshares can be tricky to pass at death and it is in your best interest to minimize the cost to your loved ones.

Authored by: Mary E. Zoldak

MacLaren Law LLC is a firm that focuses on Estate Planning, Business, and Equine Law. If you would like would to find out more information about your legal circumstances, don’t hesitate to contact us now!

Serving Columbus and Central Ohio

MacLaren Law LLC provides counsel for the estate and business planning needs of Columbus, Ohio and its surrounding communities, including: Bexley, Dublin, Upper Arlington, Worthington, Westerville, Pickerington, Pataskala, Delaware, Plain City, New Albany, Gahanna, Newark, Zanesfield, Marysville, Powell. MacLaren Law also serves Franklin, Delaware, Knox, Licking, Union, and Muskingum counties.

When it comes to estate planning, many people focus solely on documents—the will, trust, or power of attorney. But estate planning is more than just...

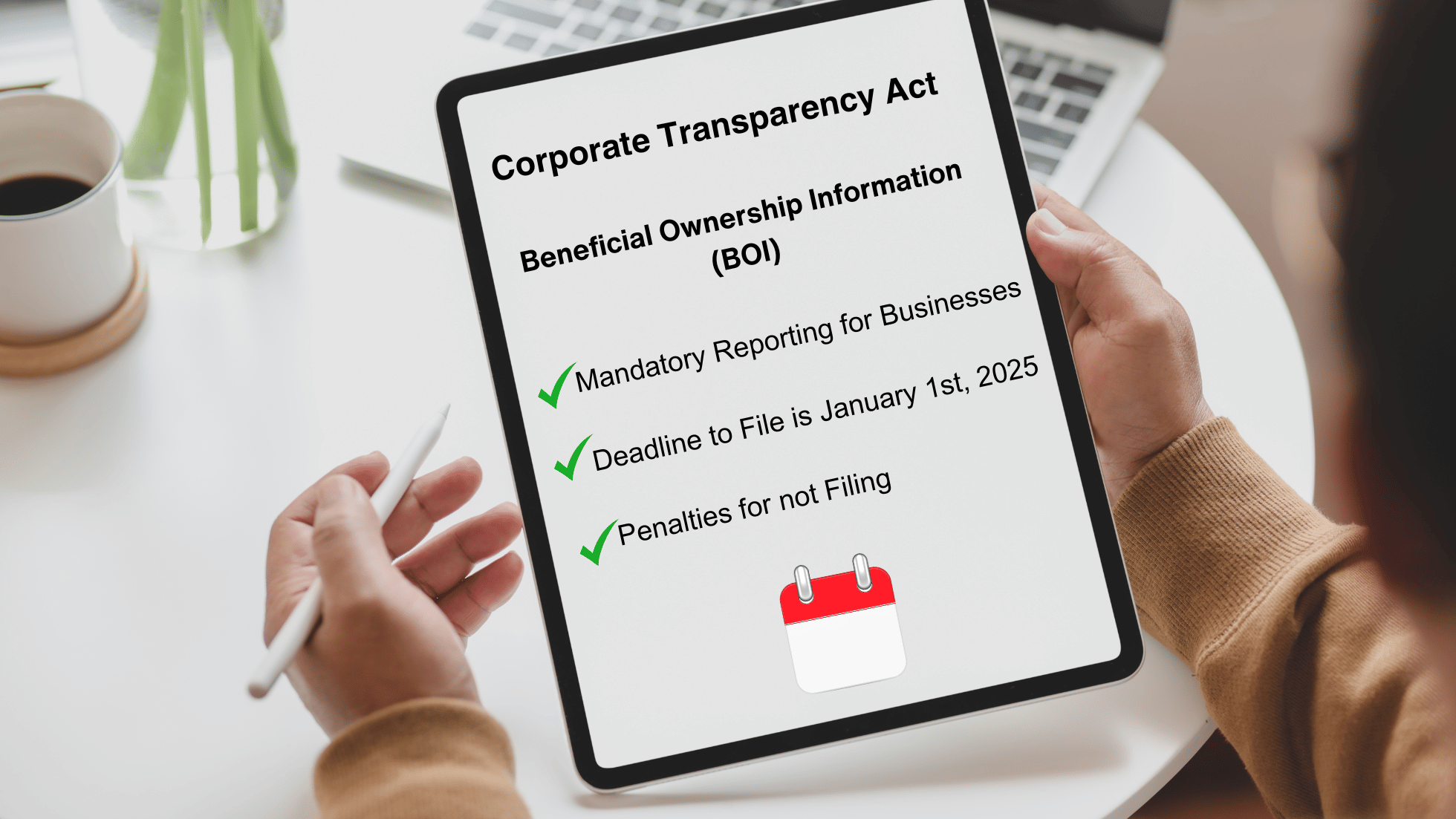

At MacLaren Law, LLC, we are committed to keeping you informed about important legal developments that impact your business. Starting January 1,...

The Risk of Do-it-yourself Estate Planning By Jacqueline Ferris MacLaren, Esq.